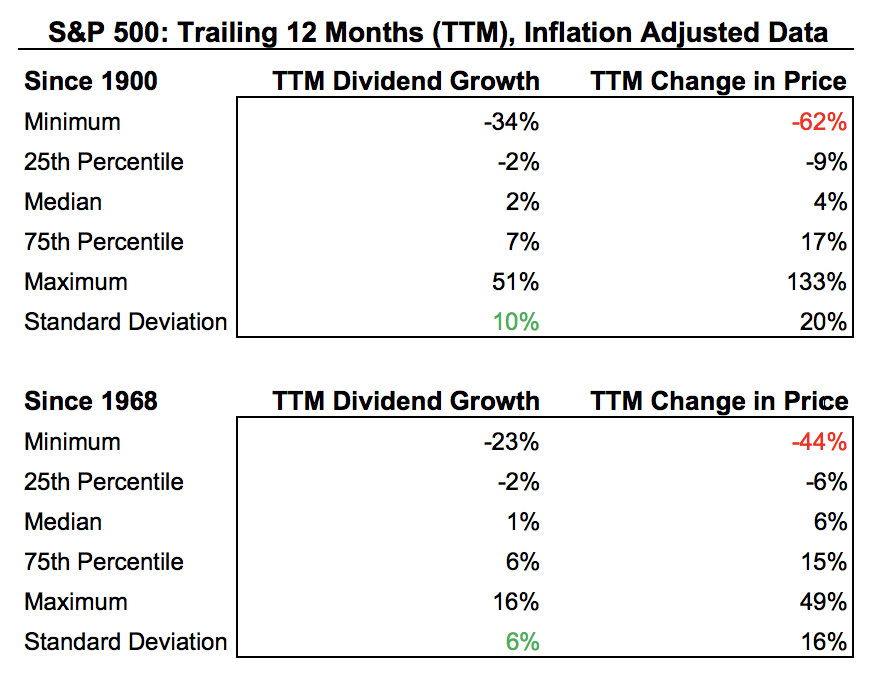

This is a great post. It should be noted that the historical worst case SWR for an all stock portfolio is around 2.5%, which is pretty close to the current dividend yield of VT.I feel the same way and only stronger with VT. Sitting cozy at a 2% dividend and even at all time high's these dividends grow 6% per year. Which means that income doubles in 12 years. Even at 5% it doubles every 15 years. So my yield on cost will be a dividend near 8% or higher for when I retire on the investments I make now. Even long term bonds don't come close. And as we saw during the financial crisis and other economic downturns, dividends are impacted significantly less than the stock price itself.I don’t get bonds at 100x. The S&P 500s yield is 1.2%. It’s all qualified dividends. At 25x, you’d need a 4%. At 50x, you’d need a 2% yield. And 100x, you’d need a 1%. And the S&P 500 yield has typically grown much faster than inflation.I'm also about 100x and SS will be close to the max benefit but my AA is 50/50. It's people like you who make me wonder if I'm being too conservative.VTSAX/Cash 99/1

>100 X

69, retired, never owned bonds. SS at 70(close to max) will largely cover basic expenses. Living the dream....

I get having some bonds on the side for a couple of years of expenses, but I struggle with 50/50 when you can live off of the dividends.

My whole goal towards retirement is using a healthy, boglehead purist market weight of stocks with VT but planning my retirement based on the income generated from my investments.

Folks are mentioning Bill Bernstein’s quote of “if you’ve won the game, stop playing”, but he has also said that if you can live off the dividends of a global stock portfolio, then that is fine too.

Statistics: Posted by aj76er — Sat Jul 06, 2024 10:19 am — Replies 451 — Views 65431